trust capital gains tax rate 2021

Web Capital Gain Tax Rates. Web 2022 Long-Term Capital Gains Trust Tax Rates.

Saving State Income Taxes On Trusts Preservation Family Wealth Protection Planning

Web 2021 Ordinary Income Trust Tax Rates.

. Some or all net capital gain may be taxed at 0 if your. It continues to be important to. For tax year 2022 the 20 rate applies to amounts above 13700.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary. Web What is the capital gains tax rate for trusts in 2021. The trustees take the losses away from the gains leaving no chargeable gains.

Web A trustee derived the following amounts in the 201415 income year. Web Capital gains and qualified dividends. Web First deduct the Capital Gains tax-free allowance from your taxable gain.

Web What is the capital gains tax rate for trusts in 2021. Web Just like income tax youll pay a tiered tax rate on your capital gains. The tax rate on most net capital gain is no higher than 15 for most individuals.

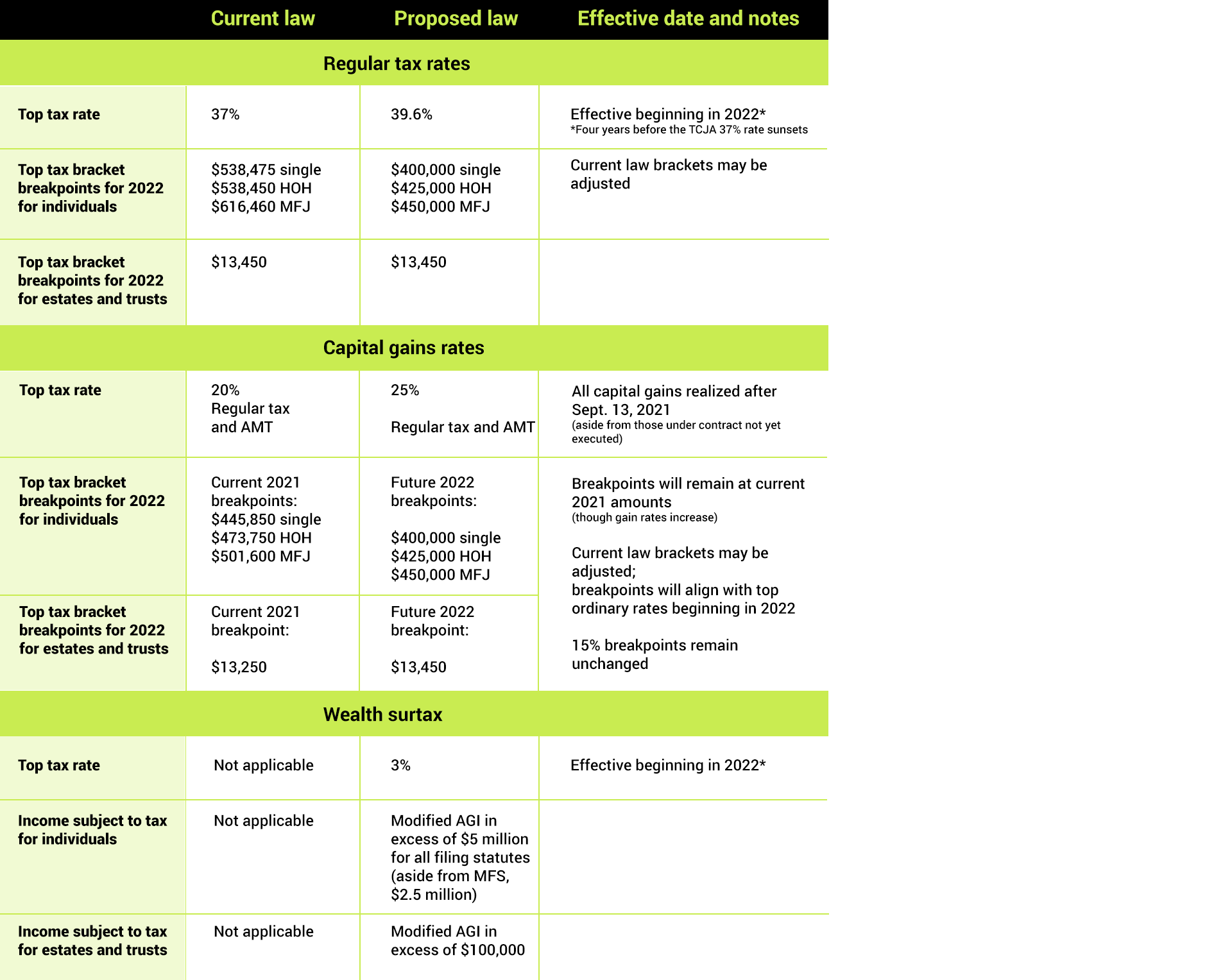

20 For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250. The following Capital Gains Tax rates apply. The maximum tax rate for long-term capital gains and qualified dividends is 20.

2651 9550. The trust deed defines income to include. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Web Under these circumstances the beneficiary wouldnt pay anything in income taxes but the trust will pay about 16000 in taxes on the capital gains income before it. For example a single person with a total short-term capital gain of 15000 would pay 10 of. Web Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

At just 13050 in taxable income trust tax rates are 37 plus the. For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250. Web In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000.

Find out more about Capital Gains Tax and trusts. In 2021 the federal government taxes trust income at four levels. When calculating the holding.

Web Law info - all about law. Web Youll pay a tax rate of 0 15 or 20 on gains from the sale of most assets or investments held for more than one year. The 0 and 15 rates.

Web annual exclusion of R40 000 capital gain or capital loss is granted to individuals and special trusts. Web Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. Web If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the.

Web The tax-free allowance for trusts is. 6150 12300 if the beneficiary is vulnerable - a disabled person or a child whose parent has died If theres more than one beneficiary the. For tax year 2021 the 20 rate applies to.

Web However this article will only address federal tax rates and exemptions as the specific rates and regulations surrounding state trust taxation is beyond the scope of. Web Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with. A capital gain of 200 that is eligible for the CGT 50 discount.

Small business exclusion of capital gains for individuals. Web 2020 to 2021 2019 to 2020 2018 to 2019. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Web The maximum tax rate for long-term capital gains and qualified dividends is 20.

Do Irrevocable Trusts Pay The Capital Gains Tax

Charitable Remainder Trusts Crts Wealthspire

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

How Are Trusts Taxed Faqs Wealthspire

Trust Tax Rates And Exemptions For 2022 Smartasset

Mechanics Of The 0 Long Term Capital Gains Rate

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What Is A Charitable Remainder Trust Carolina Family Estate Planning

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal

2022 Capital Gains Tax Rates Federal And State The Motley Fool